when a buyer can cancel a home purchase agreement" width="775" height="436" />

when a buyer can cancel a home purchase agreement" width="775" height="436" />

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

Buying a home is rarely done with casual disregard. You’ve planned, juggled finances, worried about finding the right house, and then you finally sign a contract. But what happens if you’re now facing the decision of submitting a buyer cancellation of the purchase agreement?

In this guide, we’ll break down what you need to know about buyer cancellation of a purchase agreement. From the initial understanding of what a home purchase agreement is, to the reasons why buyers may back out, and the steps involved in cancellation. We’ll also review the legal and financial repercussions that can follow.

Achieve Greater Buyer Confidence With a Top Agent

HomeLight can connect you with the most experienced buyer’s agents in your home shopping area. These top professionals can help you make the best buying decisions and protect your interests.

Disclaimer: As a friendly reminder, this blog post is meant to be used for educational purposes, not legal advice. If you need assistance navigating the legalities of canceling a purchase agreement, HomeLight always encourages you to reach out to your own advisor.

A home purchase agreement, often referred to as a real estate contract, is a legally binding document between a buyer and seller outlining the terms of a property sale. This comprehensive document details everything from the purchase price, down payment, and financing terms to contingencies, closing dates, and any specific conditions both parties must meet before the sale can be finalized.

At its core, the agreement serves as a roadmap for the transaction, providing a clear outline of what is expected from both the buyer and seller to ensure a smooth transfer of ownership. It includes key elements such as:

Buyers may decide to back out of a home purchase agreement for various reasons, including both personal circumstances and issues arising from the property itself.

Danielle Moy is a top Chicago area real estate agent with more than 16 years of experience. She says buyer’s remorse is something she’s seeing more often in the current housing market.

“That’s the main reason that I see a buyer wanting to cancel after they sign [the purchase agreement]. They have buyer’s remorse after talking to family or a lender, reevaluating their monthly payment, and then realizing it’s higher than they expected. They want to wait till the rates drop a little bit before they continue their search.” Moy adds, “We’ve seen a lot of people even back out before they drop off the earnest money.”

Here’s a quick look at common factors prompting home buyers to back out of a purchase agreement:

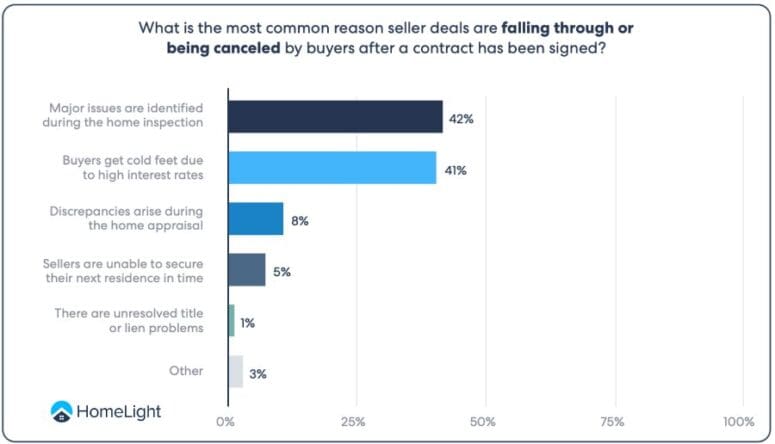

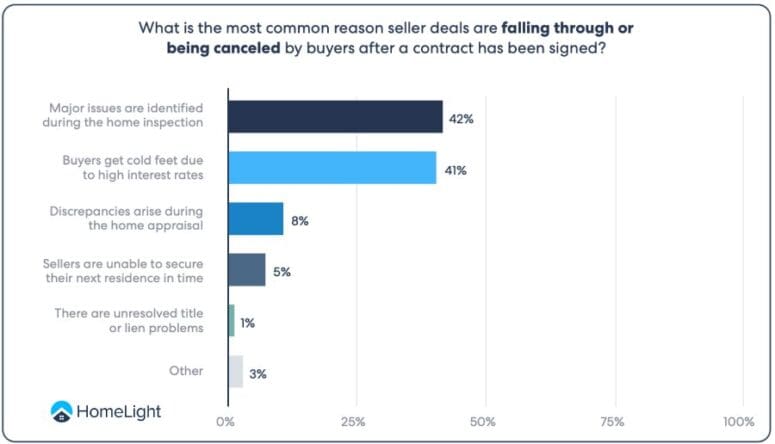

To get a better feel for what’s happening in the current market, HomeLight surveyed more than 1,000 of the nation’s top-rated real estate agents. Here is what they cited as the most common reasons buyers are canceling deals after a contract has been signed.

The option period is a specified timeframe within a real estate contract during which the buyer has the exclusive right to terminate the agreement for any reason. Typically lasting from a few days to a couple of weeks, this period allows the buyer to conduct thorough due diligence on the property, including obtaining inspections and appraisals, without the risk of losing their option fee, although the fee is often non-refundable.

The key features of an option period include:

Canceling a purchase agreement as a buyer involves several steps, often dictated by the terms of the agreement itself and state laws.

Some states require a real estate attorney to conduct the closing of a home sale. Others are considered “attorney states,” where licensed attorneys participate in the buy-sell process as a matter of custom and practice. Such is the case in Moy’s home state of Illinois.

Moy explains the initial steps: “After signing, if a buyer wants to cancel a home purchase agreement, they would first have to tell me [their agent] and their real estate attorney, and then their attorney will send out a legal letter to the other party involved on the selling side, the other attorney would then have to present that to their seller and see if the sellers and agreement based upon the reasoning.”

Here’s a general outline of the process:

Termination and release are two distinct actions in the realm of real estate contracts, each with its own implications:

Canceling a home purchase agreement can carry significant consequences for the buyer, especially if not done within the legal boundaries of the contract.

“If the buyer backs out due to not being able to get the financing, or something happens during the final walkthrough that they’re not happy with, or something’s not repaired the way it was supposed to be (what they asked for during the inspection period), then they may have every right to back out and get the earnest money back,” Moy explains. “However, if they back out just because they have a change of heart about the property, they will likely not be able to get that earnest money back.”

Here are some of the repercussions that can happen when a buyer cancels a purchase agreement:

There are specific circumstances under which a buyer can cancel a purchase agreement without facing financial penalties or legal repercussions. These situations can vary depending on state laws, but they typically revolve around unmet contingencies cited in the contract.

Moy provides some examples for her Illinois market: “If the buyer orders a home inspection, and the home inspection comes back poorly, you can back out within the first five business days, and then there are no consequences — they could get the earnest money back. Or, if they can’t buy the house anymore because they can’t afford the mortgage — maybe they lost their job — they could get their earnest money back because [most agreements] are contingent on financing as well. Or, if the final walkthrough goes poorly (like the property is not in the same condition it was), that would be another reason.”

Here’s a look at common contingency clauses that can allow a buyer to cancel a purchase agreement without significant consequences:

Moy advises buyers to take advantage of contingency clauses to protect themselves, and include safeguard timeframe requests. “They can put it in the contract, she explains. “If they want extensions for contingencies, they can say that instead of five business days for the attorney review and inspection period, they want ten days — just to give them a little bit more flexibility to back out if needed.”

You can back out of buying a house without severe consequences up until the point all contingencies in the contract are met or waived, and you proceed to closing. Once you close on the house (signed and sealed), the sale is considered final, and backing out is no longer an option. It’s important to understand the timelines and conditions of your contract’s contingencies to know your last opportunity to exit the agreement legally.

What happens to earnest money if the buyer backs out?If the buyer backs out of the transaction for reasons not covered by the agreement’s contingencies, the earnest money typically goes to the seller as compensation for the breach of contract. However, if the buyer backs out due to a failed contingency, like a poor home inspection or inability to secure financing, they are usually entitled to a refund of their earnest money.

How much time does a buyer have to back out of a contract?The specific time frame a buyer has to legally back out of a contract depends on the contingencies outlined within the agreement. For example, a financing contingency might give the buyer 30 days to secure a loan. If the buyer cannot fulfill this condition within the specified time, they can back out and potentially reclaim their earnest money. Always refer to the contract for specific timelines related to each contingency.

Can a homebuyer sue a seller after closing?A homebuyer can sue a seller after closing if they discover undisclosed defects or if the seller intentionally hid problems that affect the property’s value or livability. Legal action can be pursued based on fraud, breach of contract, or violation of disclosure laws. It’s vital to consult with a legal professional to assess the viability and potential success of such a lawsuit.

Can a home seller sue a buyer for not closing?Yes, a home seller can initiate legal action against a buyer if they fail to close the transaction without a legally valid reason. The seller may seek damages for breach of contract, including the potential loss of sale, costs associated with relisting the property, and any difference in sale price if the property sells for less the second time. The specific remedies available depend on the contract terms and local laws.

Can an agent help resolve buyer/seller disputes?Real estate agents can play a pivotal role in resolving disputes between buyers and sellers, often acting as mediators to facilitate negotiations and find mutually agreeable solutions. Agents with training in dispute resolution, such as those trained to use the National Association of Realtors DRS (Dispute Resolution System) program, are particularly skilled in these situations. In a combined program, the DRS clause can be included in an agreement to provide for a two-step process in an effort to help buyers and sellers resolve disputes out of court, first through mediation and then — if mediation is not successful — arbitration. While agents can help avoid litigation, it’s sometimes necessary to consult with legal professionals for resolution.

Whether you’re facing challenges with a purchase agreement or need help finding the right property, a top real estate agent is your ally in reaching the finish line successfully.

HomeLight can connect you with the top-rated agents in your selected market, ensuring you have the professional support to make informed decisions and achieve your real estate goals.

In closing, Moy offers this advice to buyers: “Work closely with your agent. Make sure you know what your monthly payments are going to be. Make sure you consult with your lender and family prior to making the offer. That way, when you make the offer, you’re ready, and you’re able to actually close on the deal. You also won’t face the issue of wanting to back out for no reason or getting buyer’s remorse.”

Header Image Source: (Pixabay/Pexels)

At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

Share this post